Data insight that enables informed decisions related to your financing and insurance process

Use the BTI to help enable greater transparency of the construction process and help inform your financing decisions and risk management processes.

What can BTI do for you?

Help scale sales within your asset assessment framework

Use standardised data to gain a deeper understanding of your product and asset portfolios. Enhance financing and insurance decisions within your risk management frameworks by having access to more data.

Improve customer experience through greater transparency

Use in-depth data sets to tailor loan and underwriting terms to specific assets being considered. Greater transparency of decisioning process can drive customer satisfaction and outcomes.

Drive efficiency in your loan decisioning and underwriting processes

Automate and optimise project financing and policy underwriting processes by using up-to-date data on construction practices. Consistent, high-quality data can enable improved automation and decision speed.

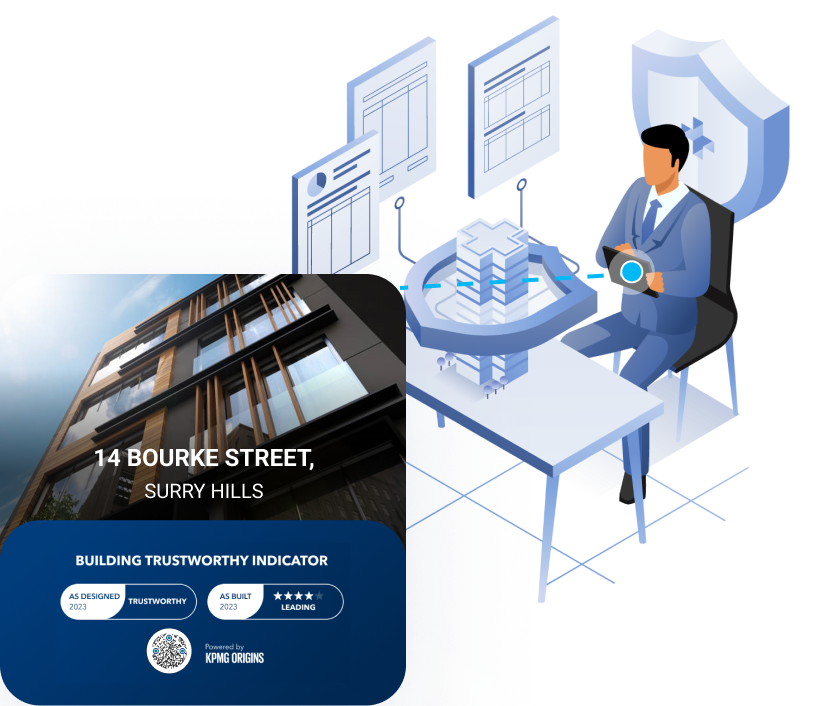

What is BTI?

The Building Trustworthy Indicator (BTI) is a market-led digital product that enables consumers to make informed decisions about their future investments and home purchases.

What is BTI?

The Building Trustworthy Indicator (BTI) is a market-led digital product that enables consumers to make informed decisions about their future investments and home purchases.

How is BTI calculated?

Sophisticated mathematical modelling transforms the data captured to produce a trustworthiness indicator for a building.